colorado springs sales tax calculator

You can print a 82. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date.

Airbnb Rules In Colorado Airbnb Laws Taxes And Regulations The Leading All In One Vacation Rental Management Software For Pros Hostaway

The average cumulative sales tax rate in Manitou Springs Colorado is 903.

. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. I report my gross and net taxable sales for my primary and subsidiary locations by using a schedule C when I file taxes. Manufactured homes in Colorado but not other forms.

Depending on local municipalities the total tax rate can be as high as 112. In addition to other taxes and fees these fees will be assessed starting July 1 2022 in accordance with the Sustainability Of The Transportation System Act SB 21-260. Divide tax percentage by 100.

Colorado Springs Sales Tax Rates for 2022. If you owe additional tax return the completed form and check. Method to calculate Colorado Springs sales tax in 2021.

65 100 0065. What is the sales tax rate in Colorado Springs Colorado. Download Or Email CO DR 0100 More Fillable Forms Register and Subscribe Now.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. Colorado has a 29 statewide sales tax rate but. Colorado Springs in Colorado has a tax rate of 825 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in.

The minimum is 29. The combined amount is. The statewide sales tax in Colorado is just 290 lowest among states with a sales tax.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. Maximum Possible Sales Tax. This downloadable spreadsheet combines the information in the DR 1002 sales and use tax rates document and.

Location Tax Rates and Filing Codes. The December 2020 total local sales tax rate was 8250. Ownership Tax Calculator Estimate ownership taxes.

The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods. This information is intended to provide basic guidelines regarding the collection of sales and use tax ownership tax and license fees. Local tax rates in Colorado range from 0 to 83 making the sales tax range in Colorado 29 to 112.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Ad Complete Tax Forms Online or Print Official Tax Documents. Colorado springs auto sales tax rate Wednesday July 27 2022 Edit.

Multiply price by decimal. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Rates are expressed in mills which are equal to 1 for every 1000 of property value.

Multiply the vehicle price after trade-ins but before incentives by the. Manitou Springs is located within El Paso. Visit the COVID-19 Sales Tax Relief web page for more information and filing instructions.

This includes the rates on the state county city and special levels. Maximum Local Sales Tax. Companies doing business in Colorado need to register.

Colorado Vehicle Sales Tax Fees Calculator Find The. The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. Average Local State Sales Tax.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. List price is 90 and tax percentage is 65. Find your Colorado combined.

For those who file sales taxes. The current total local sales tax rate in Colorado Springs CO is 8200. How Colorado Taxes Work Auto Dealers Dealr Tax.

However as anyone who has spent time in Denver Boulder or Colorado Springs. The base state sales tax rate in Colorado is 29. Colorado State Sales Tax.

The Colorado CO state sales tax rate is currently 29. The price of the coffee maker is 70 and your state sales tax is 65. The combined amount is.

Motor vehicle dealerships should review the. The Steamboat Springs Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Steamboat Springs Colorado in the USA using average Sales Tax. This is the total of state county and city sales tax.

How To Calculate Cannabis Taxes At Your Dispensary

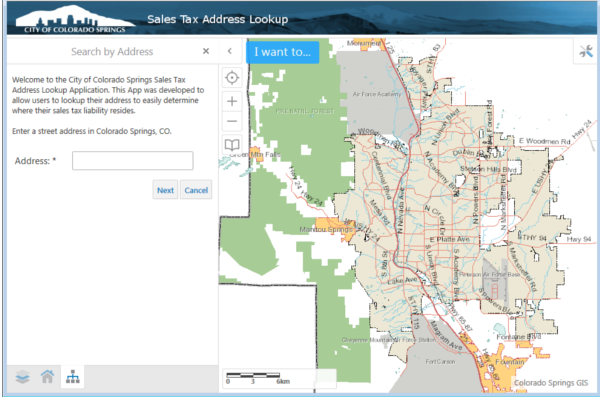

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

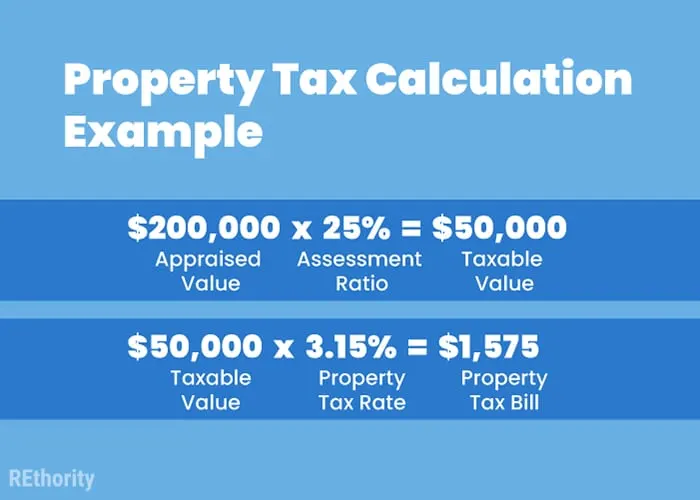

Property Tax Calculator Property Tax Guide Rethority

The Consumer S Guide To Sales Tax Taxjar Developers

Sales Tax Address Lookup Application Colorado Springs

Sales Tax Information Colorado Springs

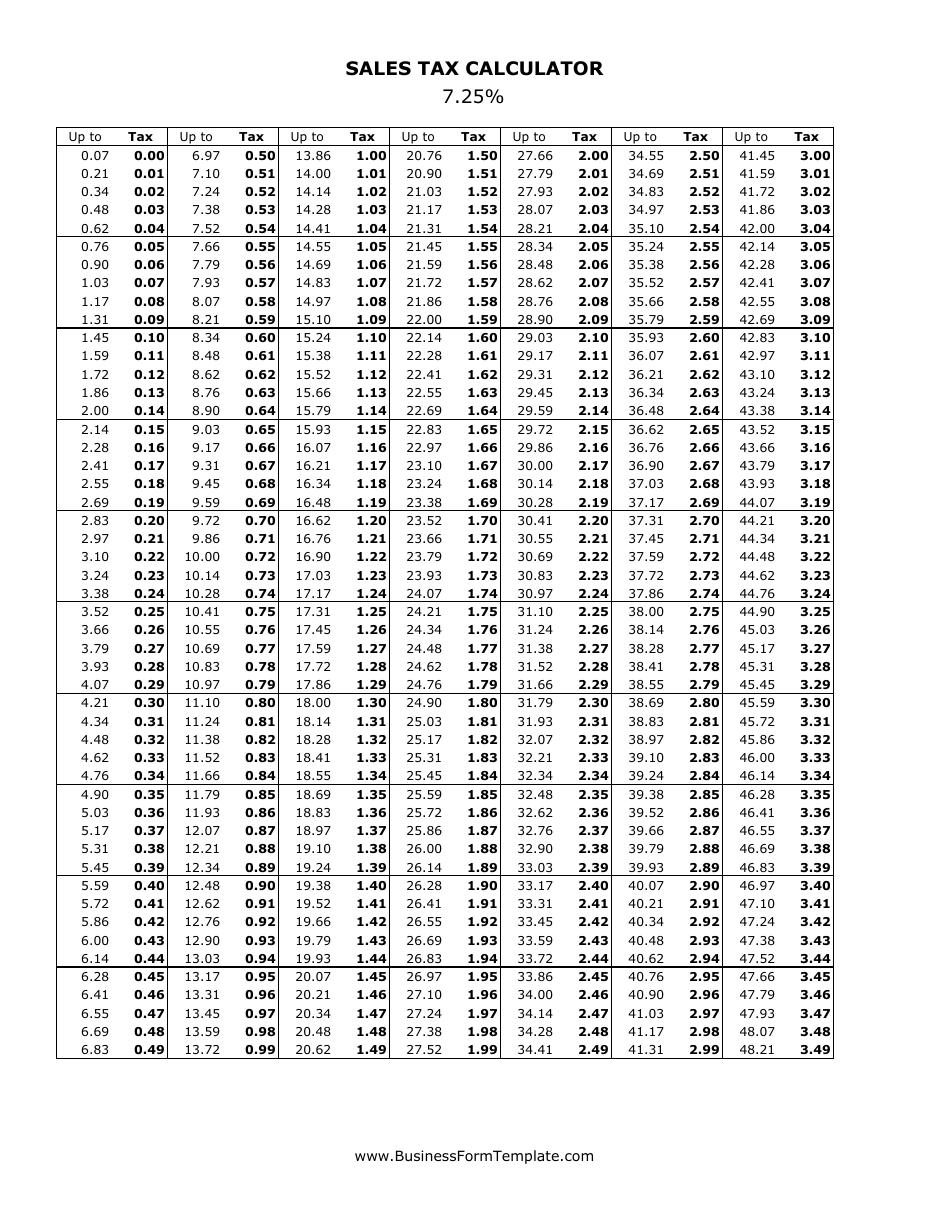

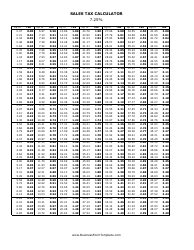

7 25 Sales Tax Calculator Download Printable Pdf Templateroller

Capital Gains Tax Calculator 2022 Casaplorer

Property Tax Calculator Property Tax Guide Rethority

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Vous Etes Francais Travaillant En Suisse Savez Vous Que Votre Salaire Brut Pourrait Etre Taxe De 7 50 Tax Preparation Tax Services Tax Return

Wyoming Sales Tax Small Business Guide Truic

Sales Tax Information Colorado Springs

Property Tax Calculator Property Tax Guide Rethority

7 25 Sales Tax Calculator Download Printable Pdf Templateroller